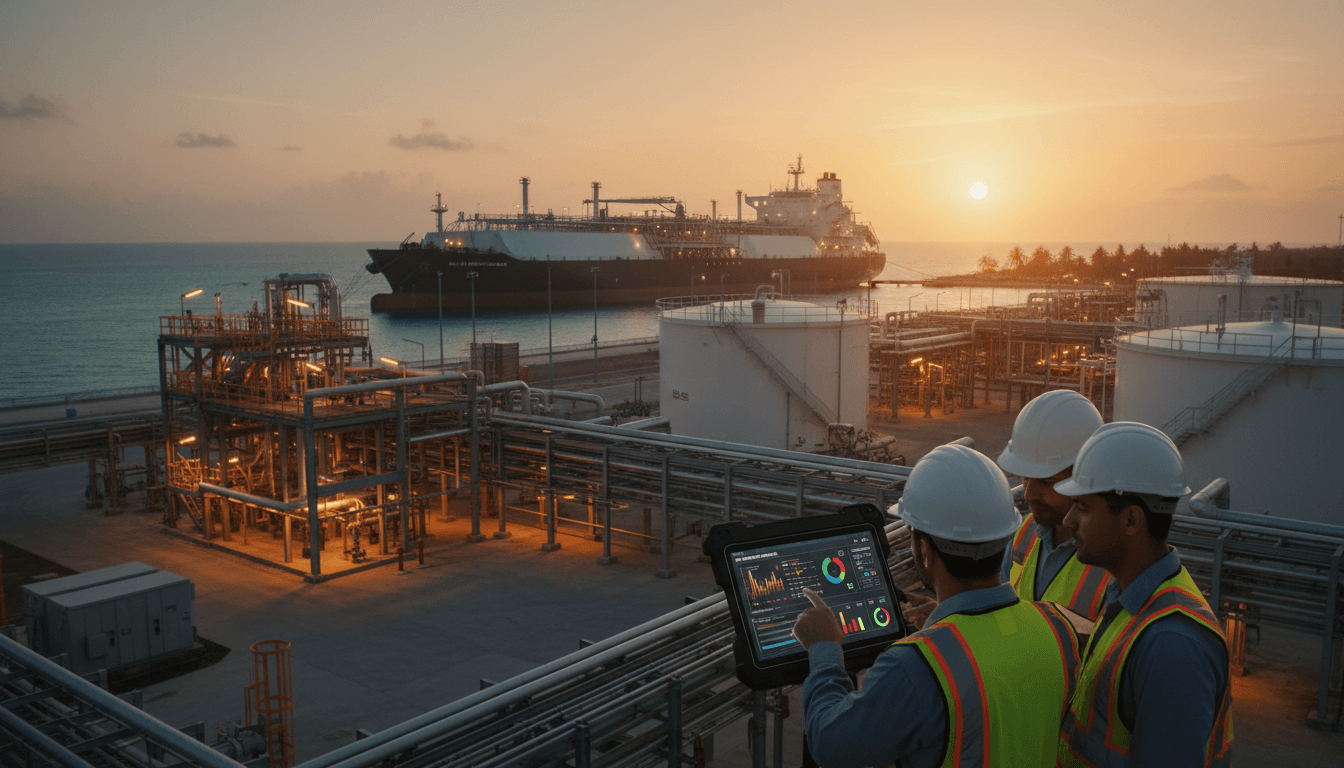

PETRONAS’ 1 mtpa LNG deal hints at a bigger shift: partnerships now demand AI-ready operations. Here’s how T&T can respond fast.

AI Lessons for T&T from the PETRONAS–CNOOC LNG Deal

PETRONAS just agreed to supply one million tonnes per year (1 mtpa) of LNG to CNOOC Gas and Power Singapore Trading & Marketing. That number matters, but the bigger story is what sits behind it: long-term energy partnerships are now being built with digital capability baked in—forecasting, optimisation, emissions reporting, and faster operational decisions.

For Trinidad and Tobago’s energy sector, the message is straightforward. If global players are pairing commercial agreements with AI and high-performance computing (HPC) programmes, local operators can’t treat AI as a “nice-to-have” innovation project. It’s becoming part of how you stay competitive, prove reliability, and meet lower-carbon expectations—even when your core business is gas.

This post is part of our series on How AI Is Transforming the Energy and Oil & Gas Sector in Trinidad and Tobago. We’ll use the PETRONAS–CNOOC deal as a lens to explain what’s changing globally—and what practical AI moves make sense in T&T right now.

What the PETRONAS–CNOOC agreement really signals

The key point: LNG contracts are increasingly tied to execution excellence. Buyers want stable volumes, predictable delivery, and credible progress on emissions. Sellers need to protect margins while operating in tighter markets and under more scrutiny.

In the reported agreement, PETRONAS LNG will deliver 1 mtpa of LNG to CNOOC’s Singapore trading and marketing arm. The deal is framed around energy security and a lower-carbon future, aligned with China’s “Dual Carbon” goals (peak emissions before 2030; carbon neutrality by 2060). That language isn’t just PR. It’s a commercial filter that affects supplier selection, contract renewals, and financing terms.

Here’s the piece many companies miss: the contract is the headline, but the operating model is the advantage. PETRONAS has also been formalising collaboration with international partners on seismic imaging advances, plus AI and machine learning supported by HPC—and it’s explicitly talking about agentic AI and dynamic modelling for real-time analysis and continuous forecasting.

A useful way to say it: today’s energy partnerships reward the companies that can “see” their operations clearly and act quickly. AI is how that visibility scales.

From “supply LNG” to “prove performance”: where AI fits

The short answer: AI turns operational data into decisions you can defend—internally, to partners, and to regulators. In gas and LNG value chains, that shows up in four places.

1) Forecasting that’s good enough for trading realities

Gas markets don’t reward average forecasts. They reward forecast accuracy during constraint events: compressor issues, unplanned shutdowns, shipping delays, feedgas variability, and weather disruptions.

AI-driven forecasting typically combines:

- Historical production and downtime patterns

- Maintenance signals (vibration, temperature, lube oil quality)

- Process conditions (pressures, flows, heat exchanger performance)

- Shipping and terminal constraints

- Commercial nominations and swing clauses

For Trinidad and Tobago—where Atlantic LNG, upstream gas supply, and downstream industrial demand are deeply interdependent—better forecasting isn’t academic. It reduces:

- Over-promising volumes (and paying penalties)

- Under-utilising capacity (and leaving cash on the table)

- Last-minute firefighting that drives unsafe decisions

2) Reliability engineering that actually prevents downtime

Most companies still run reliability as a reporting function: “what failed, what did it cost.” AI makes reliability predictive and operational.

A practical example that fits T&T facilities: compressor and rotating equipment predictive maintenance. Models can flag early signs of failure weeks ahead, allowing you to schedule interventions around production and shipping windows.

The business logic is simple:

- LNG and gas plants make money when they run steadily

- Unplanned downtime is expensive and often contagious across the value chain

- Predictive maintenance is one of the fastest AI use cases to show ROI because it connects directly to availability

3) Emissions measurement and reporting that doesn’t collapse at audit time

The industry is moving toward better methane measurement and more credible carbon accounting. The operational pain point is data quality: missing tags, manual spreadsheets, inconsistent assumptions, and site-to-site variation.

AI helps in two ways:

- Anomaly detection to catch unusual emissions-related behaviour (e.g., abnormal flaring signatures, valve issues, instrumentation drift)

- Automated reconciliation between process data, maintenance logs, and reporting templates

This matters because commercial partners increasingly expect a supplier to answer questions like:

- “How confident are you in your methane intensity?”

- “What changed quarter-over-quarter—and why?”

- “Show me the data trail.”

If you can’t answer quickly, you lose time, credibility, and sometimes the deal.

4) Decision automation (agentic AI) with guardrails

“Agentic AI” is showing up more in energy conversations because it promises more than analytics dashboards. The goal is systems that can:

- Monitor live conditions

- Predict what happens next

- Recommend actions

- Execute approved actions within constraints

In oil and gas, the best use of agentic AI is narrow and controlled. Think:

- Suggesting optimal setpoints for energy efficiency

- Recommending maintenance windows based on predicted failure probability

- Triggering work orders when confidence thresholds are met

The stance I take: agentic AI is valuable, but only after you fix data and governance. Otherwise, you’re automating confusion.

What Trinidad and Tobago can copy (and what it shouldn’t)

The key point: T&T doesn’t need to copy the scale of PETRONAS—it needs to copy the sequencing. Big national oil companies can fund massive AI programmes. Smaller operators and local service providers win by picking the right first moves.

Copy this: partnerships that share data and outcomes

The PETRONAS story includes wide collaboration—energy companies plus technology partners—focused on seismic imaging, AI/ML, and HPC. That mix matters.

In T&T, the strongest model I’ve seen work is a partnership that’s explicit about:

- What data is shared (and what isn’t)

- Who owns the model outputs

- How cybersecurity is enforced

- What operational KPI improves (availability, fuel gas use, flaring, maintenance cost)

If the partnership can’t name the KPI in one sentence, it’s usually not ready.

Copy this: digital capability as part of commercial strength

Global LNG buyers are getting stricter. Reliability and emissions transparency affect negotiation power.

A practical way to think about it:

- Commercial teams sell volumes

- Operations teams protect deliverability

- AI teams make deliverability measurable and repeatable

When those three aren’t connected, you get contracts that operations can’t realistically support.

Don’t copy this: “AI everywhere” roadmaps

A common failure pattern is launching 20 pilots, then scaling none.

T&T energy organisations should resist that and start with 2–3 use cases that:

- Touch high-cost pain (downtime, energy use, flaring)

- Have clear data sources

- Can be integrated into existing workflows (CMMS, DCS/SCADA, planning)

A practical AI roadmap for T&T energy operators (90 days to 12 months)

The key point: AI adoption works when you treat it like operations—not like a demo. Here’s a sequence that fits most upstream, midstream, and plant environments in Trinidad and Tobago.

Phase 1 (0–90 days): pick use cases and fix data access

Focus on speed and clarity.

Deliverables to aim for:

- One-page use case charters (problem, KPI, data, owner)

- Data inventory: historians, lab systems, maintenance logs, production accounting

- A minimum cybersecurity and access model (roles, logging, segmentation)

Good first use cases in T&T contexts:

- Rotating equipment anomaly detection

- Flaring event classification and root-cause clustering

- Production shortfall prediction (next 7–14 days)

Phase 2 (3–6 months): build models people will actually use

A model that sits in a notebook isn’t a product.

What to build:

- Alerts integrated into existing tools (email, Teams, or the maintenance system)

- Simple explanations: “which sensors drove this alert”

- A feedback loop so engineers can label false positives and improve the model

The success metric: operators trust it enough to change a decision.

Phase 3 (6–12 months): scale with governance and MLOps

Scaling isn’t adding more models. It’s adding repeatability.

What ‘scaled’ looks like:

- Standard pipelines for data ingestion and quality checks

- Versioned models with audit trails

- KPI tracking that ties directly to financial impact

- A clear approval boundary for any semi-automated actions

This is where AI becomes part of how the asset runs, not an innovation side project.

Questions leaders in T&T should be asking right now

The key point: good questions force operational readiness. If you lead an energy company, a plant, a services firm, or a trading function in Trinidad and Tobago, these are the questions that surface real gaps quickly:

- If a buyer asked for our deliverability proof, what data would we show—today?

- What’s our top downtime driver by cost, and do we have the sensor coverage to predict it?

- How many critical decisions still rely on manual spreadsheets? (If it’s “most,” start there.)

- Can we quantify methane, flaring, and energy intensity with a consistent method across assets?

- Do we have a single owner for AI in operations, or is it split across IT and “innovation”?

If you can answer these cleanly, you’re ahead of the regional curve.

What this means for the next big energy partnership in T&T

The PETRONAS–CNOOC LNG agreement is a reminder that energy deals are increasingly built on two promises: security of supply and credible progress toward lower-carbon operations. AI is how companies keep those promises at scale.

For Trinidad and Tobago, the opportunity is to treat AI as a competitiveness tool: improve uptime, forecast better, reduce energy waste, and produce emissions data that holds up when partners ask hard questions. The companies that start now won’t just run better—they’ll negotiate from a stronger position.

If you’re planning a 2026 digital initiative, don’t start with a flashy platform. Start with one operational pain point that costs real money every month, attach it to a KPI, and build an AI workflow your engineers will actually use. What would your “1 mtpa deal” look like if your operations could prove performance in real time?