Amazon’s India logistics merger signals a shift to end-to-end integration. Here’s how Sri Lanka’s apparel sector can use AI to improve OTIF, planning, and compliance.

Amazon-India Merger Lessons for Sri Lanka’s AI Apparel

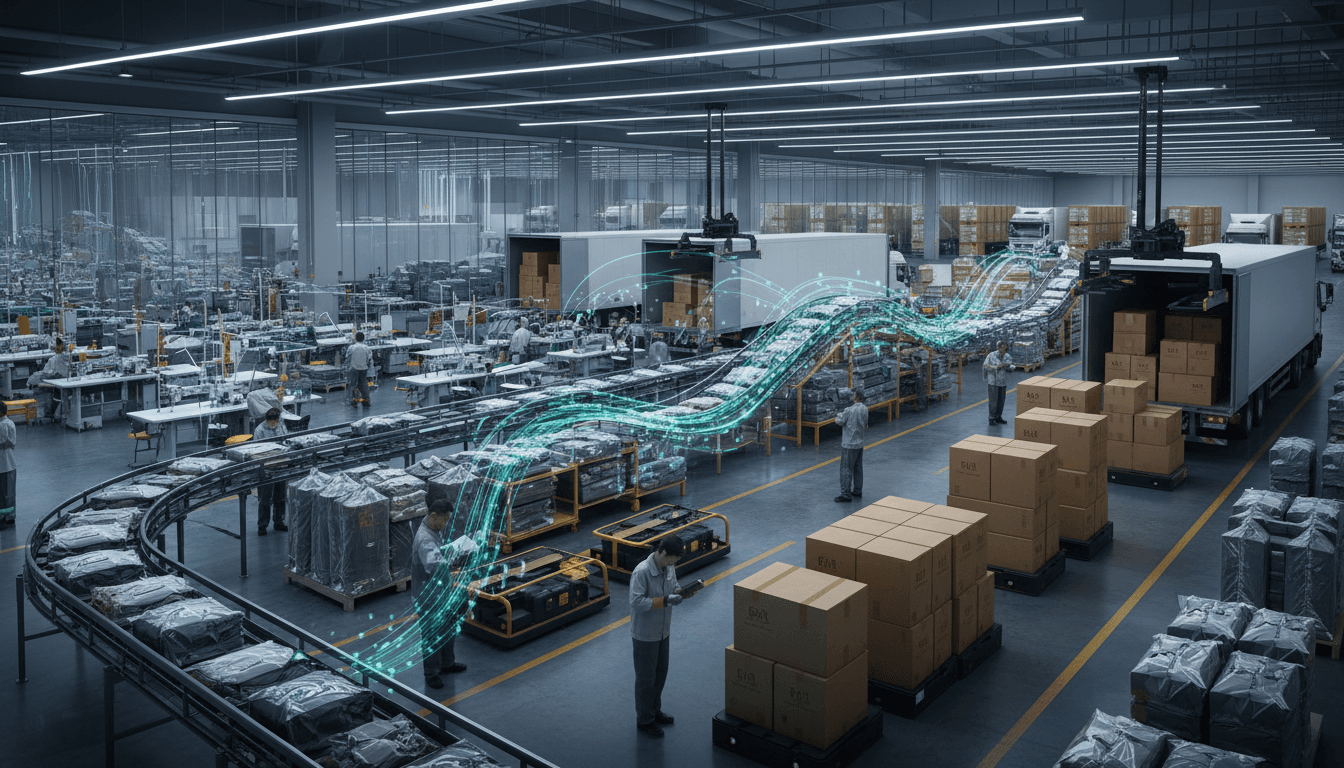

Amazon just got a legal green light in India to merge its in-house logistics arm (Amazon Transportation Services) into its marketplace entity (Amazon Seller Services). On paper it’s a corporate restructuring story. In practice it’s a loud signal about where the entire supply chain is headed: tight integration, data flowing end-to-end, and automation that removes handoffs.

For Sri Lanka’s textile and apparel industry, this matters for one simple reason. Buyers don’t only judge you by sewing quality anymore. They judge you by speed, predictability, traceability, and how cleanly you plug into their digital commerce ecosystems—especially going into 2026 planning, when brands are pushing shorter lead times and more frequent replenishment.

This post is part of the series “ශ්රී ලංකාවේ වස්ත්ර හා ඇඳුම් කර්මාන්තය කෘත්රිම බුද්ධිය මඟින් කෙසේ වෙනස් වෙමින් තිබේද”. The Amazon news is our prompt to talk about something many factories still treat as “someone else’s problem”: logistics + marketplace + production as one connected system—and the role AI plays in making that system run.

What Amazon’s merger really says: integration beats optimisation

The headline is about NCLT approval. The subtext is about control and coordination. Amazon’s stated reason is operational synergies—logistics and marketplace are complementary parts of the same value chain. That’s corporate language for: “We want fewer seams between teams, systems, and decisions.”

In the article’s financial context, Amazon’s marketplace entity reported turnover above Rs. 25,406 crore (US $ 2.83B) in FY 2023–24, while the logistics unit had operating revenue of Rs. 4,889 crore (US $ 544M). Both were reported as loss-making at the time. That combination—scale plus margin pressure—is exactly when companies stop tolerating inefficiency.

Here’s the key lesson for Sri Lankan apparel manufacturers: optimising one department won’t save you when the bigger problem is handoffs. You can have a strong IE team, great QA, even decent ERP usage—yet still lose money because the business is fragmented.

Integration is the point. AI is the enabler.

A practical translation for apparel factories

Amazon is merging “marketplace” and “transportation.” Sri Lankan factories should think in equivalent blocks:

- Demand signals (buyer forecasts, e-commerce replenishment, POS trends)

- Production reality (capacity, line efficiency, WIP, constraints)

- Logistics execution (trim arrivals, freight booking, shipment planning, delivery performance)

When these are managed as separate islands, you get the most expensive outcome in apparel: surprises.

The hidden opportunity: AI turns logistics from a cost centre into a planning engine

Most companies get this wrong: they treat logistics as a “dispatch function” that starts after production finishes. That thinking belongs to a slower era.

Amazon’s integration is designed to keep fulfilment and delivery tightly coordinated while staying compliant with marketplace rules. In apparel terms, the equivalent is using AI to make logistics part of planning from day one.

Where AI helps immediately (without buying new machines)

You don’t need a robotics budget to get value. You need cleaner data, a few targeted models, and operational discipline.

-

ETA prediction for inbound materials

If fabric or trims are late, the line plan collapses. AI-based ETA models can learn from historical supplier performance, port congestion patterns, and courier/freight variability to predict risk earlier than humans usually can. -

Shipment planning with constraint awareness

AI can propose shipment splits based on carton readiness, buyer priority, vessel cutoffs, and cost trade-offs (air vs sea vs partial shipments), instead of relying on manual spreadsheets. -

Exception management that actually works

The value isn’t “dashboards.” The value is alerts that trigger decisions:- “Style A is trending late; switch Line 3 to Style B to protect OTIF.”

- “Trim vendor X has a 22% late-delivery pattern for peak months; buffer by 5 days or dual-source.”

A good rule: If a person in your factory says, “We found out too late,” that’s a machine-learning use case.

Why this fits Sri Lanka right now

Sri Lanka competes on reliability and compliance, not ultra-low cost. AI strengthens that positioning because it supports:

- On-time delivery (OTD/OTIF) consistency

- Lower expediting (air freight) spend

- More credible capacity commitments to buyers

And as global e-commerce growth normalises and competition increases (exactly what the RSS story points to), brands reward vendors who can operate like integrated networks.

Marketplace thinking is coming to manufacturing—whether we like it or not

Amazon’s move is also happening under tighter regulatory scrutiny and increased debate about platform neutrality. That pressure forces better internal governance.

Sri Lankan manufacturers face a parallel pressure from buyers and regulators: traceability, social compliance, and environmental reporting. It’s not optional, and it’s not getting simpler.

AI’s role here isn’t “cool tech.” It’s doing the boring work faster and more accurately.

AI for compliance workflows (the work nobody loves)

If you’re exporting, you already know the pain: audits, CAPA follow-ups, document requests, chemical registers, sub-supplier declarations.

AI can support:

- Document classification and retrieval (find the right certificate fast)

- Automated checklist validation (flag missing fields before submission)

- Supplier risk scoring (based on historical non-conformities and responsiveness)

This is directly aligned with the series theme: අනුකූලතා ක්රියාවලීන් ස්වයංක්රීය කිරීම isn’t only about cost. It reduces missed deadlines and buyer friction.

AI for communication with global brands

One under-discussed advantage: AI improves how you communicate.

- Generate buyer-ready production updates from ERP/MES snapshots

- Draft corrective action narratives consistently

- Create product and process content for buyer portals

If your merchandisers spend hours rewriting status emails, that’s wasted high-value talent.

A blueprint Sri Lankan apparel leaders can copy: “one entity, one view”

Amazon is simplifying structure to improve integration and scale efficiencies. You don’t need a merger to copy the operating model.

The apparel version is one operational truth shared across planning, production, quality, and logistics.

Step 1: Build a single data spine

Answer first: AI fails when data is fragmented.

Minimum viable data spine:

- Purchase orders + style master data

- Line plan + capacity calendar

- WIP tracking (even basic scan points)

- Quality outcomes (defect categories, rework)

- Logistics milestones (booking, cutoff, departure)

If this lives in separate Excel files owned by different teams, AI can’t help you.

Step 2: Pick two KPIs that matter to buyers

Factories drown in KPIs. Choose two, operationalise them, then expand.

Good starters:

- OTIF (On Time In Full)

- Right First Time / DHU trend

Then connect AI use cases to those KPIs. If a tool can’t move OTIF or quality consistency, it’s a distraction.

Step 3: Start with “decision automation,” not “full automation”

There’s a better way to approach this: automate decisions before you automate physical processes.

Examples:

- Recommend line swaps when delays hit critical path

- Suggest inspection intensity based on risk (new fabric lot, new operator group, historical defect trend)

- Prioritise shipments by penalty exposure and buyer importance

This is cheaper, faster, and easier to adopt.

What this means for 2026: speed + predictability will beat cheap

The RSS story mentions rising competition and slower e-commerce growth. That combination drives platforms to squeeze inefficiency. Brands will do the same to suppliers.

Sri Lanka’s competitive advantage won’t come from trying to be the cheapest. It will come from being the most predictable high-compliance partner in the region.

My stance: AI is now part of that predictability. Not because everyone needs fancy models, but because the old way—manual planning, reactive firefighting, fragmented systems—can’t keep up with shorter cycles and tighter scrutiny.

If Amazon believes integration is worth structural change, it should be a wake-up call. Apparel factories can get many of the same benefits with smarter data and targeted AI—without changing ownership structures.

A useful one-liner for leadership teams: “If the factory can’t see it early, it can’t fix it cheaply.”

Next step (practical and lead-focused)

If you’re a Sri Lankan apparel manufacturer or exporter, take one week and map your “handoff chain”:

- Where does data get retyped?

- Where do approvals wait on WhatsApp?

- Where do you discover delays only after the line is already running?

Those are your first AI automation opportunities.

As this series continues, we’ll go deeper into AI for production efficiency, quality control (computer vision), and digital content for stronger buyer communication. The bigger question to carry forward is simple: when buyers operate as integrated digital networks, can your factory still afford to operate as disconnected departments?