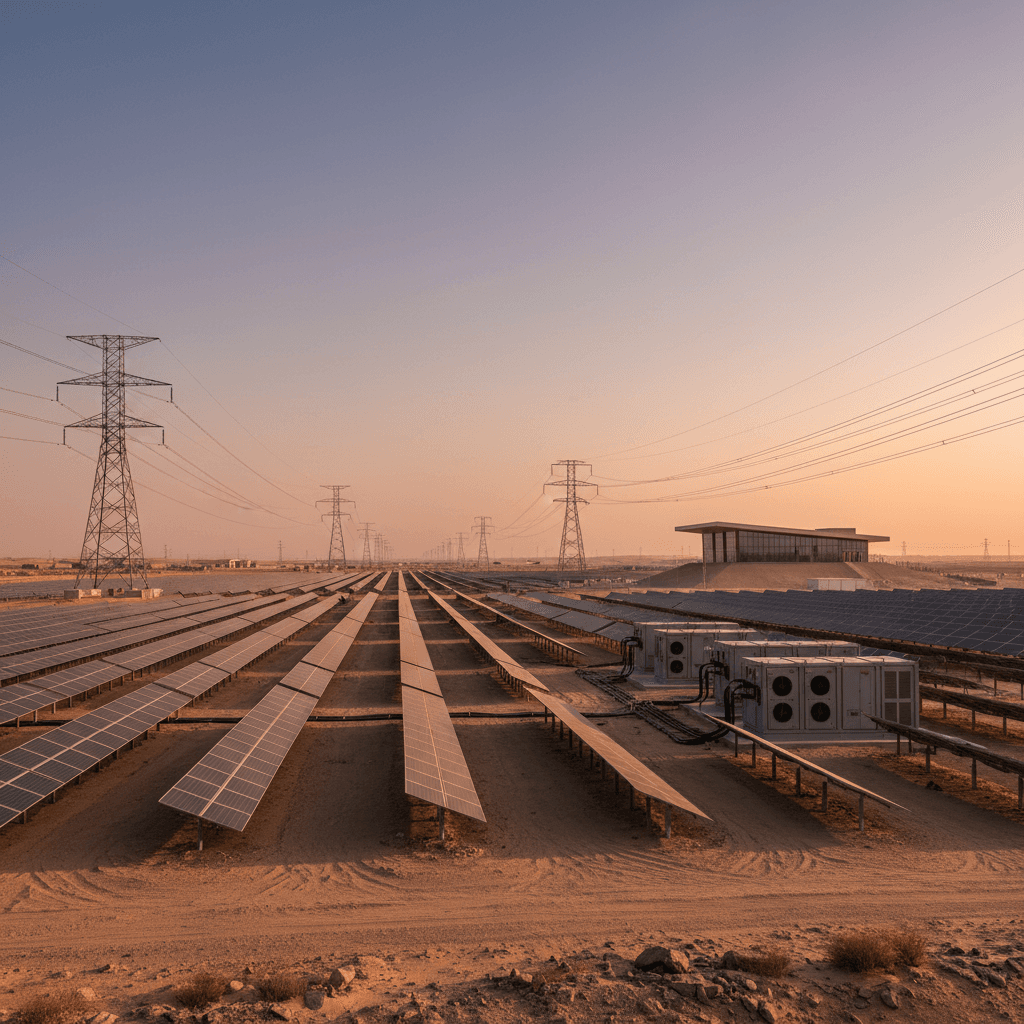

Egypt’s 1.2GW solar + 720MWh storage deal shows how to pair policy, PPAs, and AI-driven optimisation to build a reliable, low-carbon grid at scale.

Most countries talk about energy transition targets. Egypt just signed contracts to hard‑wire them into the grid: 1.2GW of new solar and 720MWh of battery storage under long-term power purchase agreements.

This matters because solar on its own is no longer enough. For a reliable, low‑carbon grid, solar has to arrive with storage attached. That’s exactly what the Hassan Allam Utilities Energy Platform and Infinity Power projects in Benban and Minya are designed to do—backed by Egypt’s Ministry of Electricity and Renewable Energy and the national TSO (EETC).

For anyone working in green technology, clean power procurement, or grid planning, this is a real-world template: how to scale renewables, build resilience, and make the numbers work.

Why Egypt’s Solar‑Plus‑Storage Deal Is a Big Signal

Egypt isn’t just adding more solar; it’s baking storage into utility‑scale PPAs and aligning it with national climate targets.

The agreement covers:

- 200MW solar + 120MWh storage in Benban (target COD: Q3 2026)

- 1GW solar + 600MWh storage in Minya (target COD: Q3 2027)

That’s enough solar capacity to meaningfully support Egypt’s push to:

- Reach 42% renewables in the power mix by 2030

- Hit 65% renewables by 2040

- Deploy 3.3GW of battery energy storage systems (BESS) by 2030

Here’s the thing about this deal: it shows what “serious” energy transition policy looks like.

- The government is on the hook via long-term PPAs.

- The TSO is directly involved, so projects are built where the grid needs them.

- Storage is treated as core infrastructure, not an optional add‑on.

For green technology investors and developers, that’s exactly the combination that de‑risks projects and accelerates deployment.

How Solar‑Plus‑Storage Stabilises a Growing Grid

Solar-plus-storage isn’t just about clean megawatt‑hours. It’s about controlling when and how those megawatt‑hours hit the grid.

The core value stack

Projects like Benban and Minya can support the grid in ways a standalone solar farm can’t:

-

Peak shaving

Batteries can charge when the sun is strongest and wholesale prices are low, then discharge into the grid during evening peaks. That:- Reduces stress on transmission lines

- Cuts reliance on expensive peaker plants

- Stabilises prices for consumers over time

-

Firming and shaping solar output

Short clouds shouldn’t mean voltage swings. Storage can smooth PV output, helping the TSO hold frequency and voltage within tight bands. That makes it easier to integrate more renewables without compromising reliability. -

Ancillary services

Utility‑scale BESS can deliver:- Frequency regulation

- Spinning reserve

- Black start capability in some configurations

In systems with rising solar penetration, these services are no longer “nice to have”; they’re essential to keep the lights on.

-

Deferring grid upgrades

By strategically placing storage where the network is constrained, TSOs can postpone or avoid very expensive transmission expansions. That’s exactly where smart planning with AI and grid analytics pays off.

The reality? Solar-plus-storage is the architecture that lets countries move from renewables experiments to renewables as backbone.

Where AI Fits: Optimising Green Technology at Scale

On paper, 720MWh of storage sounds straightforward. In practice, getting full value from that battery capacity is an optimisation problem—and that’s where AI is already central to green technology.

1. Smarter project siting and sizing

Developers and TSOs can use AI models to:

- Analyse historical solar irradiance, demand profiles, and congestion patterns

- Simulate how different PV/BESS size ratios perform under 1000s of scenarios

- Identify the sweet spot between capex, operating margins, and system benefits

For a country targeting 3.3GW of BESS, those optimisations translate into billions in avoided overbuild or under‑performance.

2. Intelligent dispatch and energy management

Modern battery energy storage systems rely on AI‑driven software to make micro‑decisions continuously:

- When to charge and discharge

- How to bid into multiple revenue streams (energy, capacity, ancillary services)

- How to avoid excessive cycling that shortens battery life

Well‑tuned AI dispatch systems can:

- Increase project revenues by 10–30% versus fixed-rule strategies

- Extend battery lifetime by reducing unnecessary deep cycles

For a PPA‑backed plant in Egypt or anywhere else, that’s the difference between a decent return and an excellent one.

3. Predictive maintenance and reliability

AI‑based monitoring can flag issues—like cell degradation patterns or inverter anomalies—before they cause outages. That means:

- Higher availability

- Lower O&M costs

- More predictable cashflows

For TSOs and regulators, it also builds confidence that storage assets are dependable grid resources, not experimental tech.

Lessons for Policymakers and Utilities

Most countries say they want more green technology. Egypt’s PPA structure shows how to actually get it financed and built.

Design policies that pair renewables with storage

Standalone solar will only take a grid so far. If you’re writing policy or regulation, consider:

- Bundled tenders where storage is required above certain solar or wind sizes

- Time‑of‑delivery or flexibility‑based tariffs that reward dispatchable clean power

- Recognition of capacity and ancillary services in market design, not just energy

When storage is monetised properly, developers design for grid value, not just for peak output.

Put the TSO at the centre of planning

Egypt brought the Egyptian Electricity Transmission Company (EETC) into the agreements from day one. That matters.

When the grid operator has a seat at the table:

- Storage is placed at network pinch points, not just where land is cheap

- Interconnection studies are integrated into early project design

- Curtailment risk is reduced for everyone

I’ve seen too many projects globally where renewables and the grid were planned in parallel, not together. The result is congestion, curtailment, and frustrated investors.

Use PPAs to send clear long‑term signals

For utilities and large offtakers, well‑structured PPAs are still the workhorse of clean energy financing.

Elements that tend to work well:

- Tenors aligned with asset life (15–25 years)

- Indexation that protects both sides from extreme inflation

- Clear performance metrics for storage (capacity, availability, response time)

Get those right and you’ll attract serious developers, not just speculative bids.

What This Means for Green Tech Businesses and Investors

Egypt is a regional case study, but the playbook is globally relevant. Whether you’re in North Africa, the Middle East, or another emerging market, there are clear opportunities.

For developers and IPPs

- Design for flexibility, not just capacity. PV+storage projects that can respond to price signals and grid needs will win more PPAs.

- Invest in strong software partners. The hardware is increasingly commoditised; optimisation software is where margins and differentiation live.

- Build local partnerships. Hassan Allam and Infinity Power show the value of combining local presence with global expertise.

For corporates and large energy buyers

If you’re pursuing net‑zero targets, these projects show what’s possible:

- Long‑term green PPAs with firmed, time‑shaped delivery

- Hybrid solutions that combine on‑site solar, off‑site solar‑plus‑storage, and energy management systems

You don’t have to wait for your government to replicate Egypt’s model. You can start designing corporate PPA structures that demand storage with renewables.

For technology providers and AI startups

The shift to utility‑scale storage creates demand for:

- Forecasting and optimisation platforms

- Grid analytics and congestion prediction tools

- Battery health and lifecycle management software

If your product makes PV+storage more predictable, more profitable, or easier to integrate, you’re standing in the right place at the right time.

Where This Fits in the Green Technology Story

Within our Green Technology series, Egypt’s solar‑plus‑storage deal is a textbook example of policy, infrastructure, and AI‑driven optimisation converging.

- Policy sets the direction: 42% renewables by 2030, 65% by 2040

- Infrastructure delivers the hardware: 1.2GW of solar, 720MWh of storage

- AI and digital tools maximise the value of every MWh

The bigger picture is clear: the next wave of clean energy growth isn’t just about installing more panels and turbines. It’s about building intelligent, flexible systems where generation, storage, and software work as one.

If your organisation wants to be part of that shift—whether as a buyer, developer, or technology partner—the question isn’t if you’ll integrate storage and AI. It’s how quickly you can realign your strategy to match where the grid is heading.